- Orient Plaza Plot 6/6A , Kampala Road

- Monday to Friday: 9am to 6pm

In recent years, Ugandans have been increasingly turning to Microfinance Deposit-taking Institutions (MDIs) over traditional banks for their borrowing needs.

Uganda's banking sector has seen a decline in non-performing loans (NPLs), particularly in shilling-denominated loans, reflecting improved financial health

Facing reduced external borrowing options, the Ugandan government is increasingly relying on domestic financiers to bridge funding gaps.

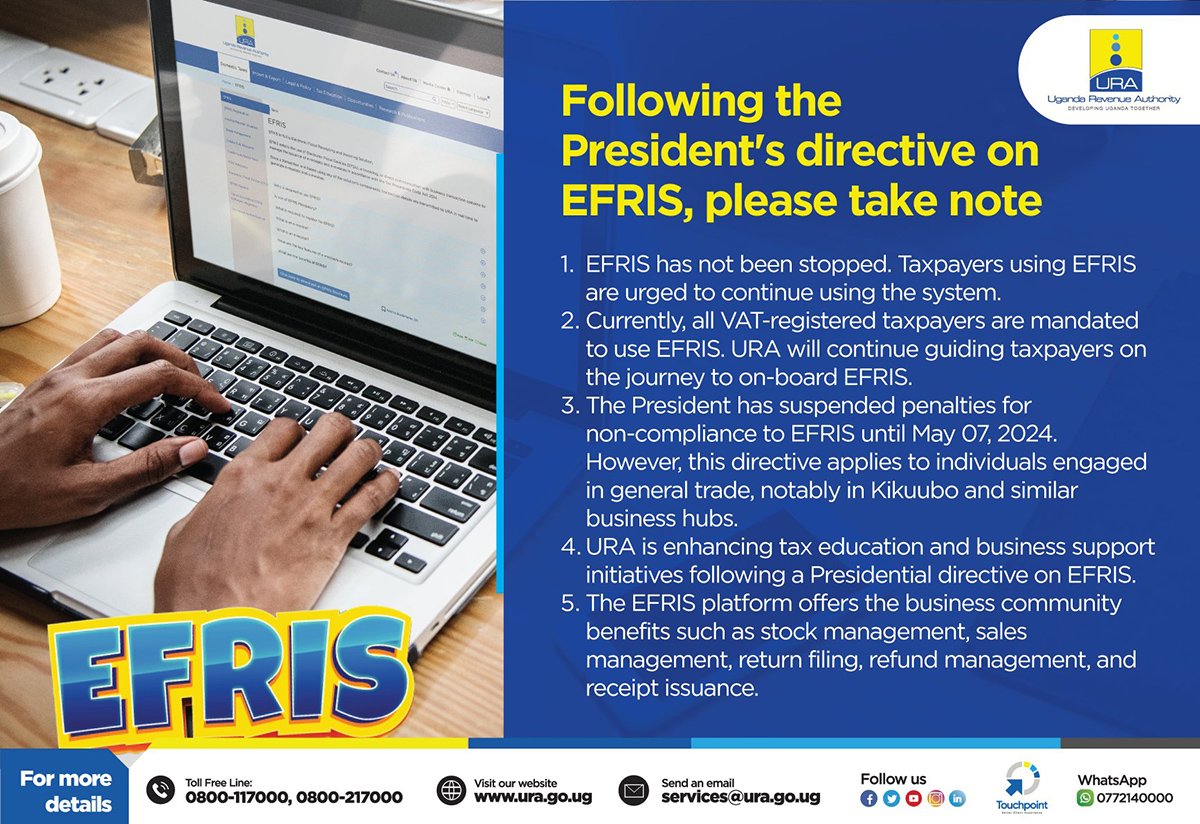

The EFRIS system is intended to help the URA record taxpayers’ transactions and share that information with the URA.

Uganda's strategic implementation of an Import Substitution and Export Promotion policy is a bold move aimed at strengthening local industries and enhancing the country's economic resilience

Uganda's banking sector is undergoing a significant transformation, driven by rapid technological advancements and a growing demand for financial services.