EFRIS , A Tool for Increased Taxpayer Cash Flow

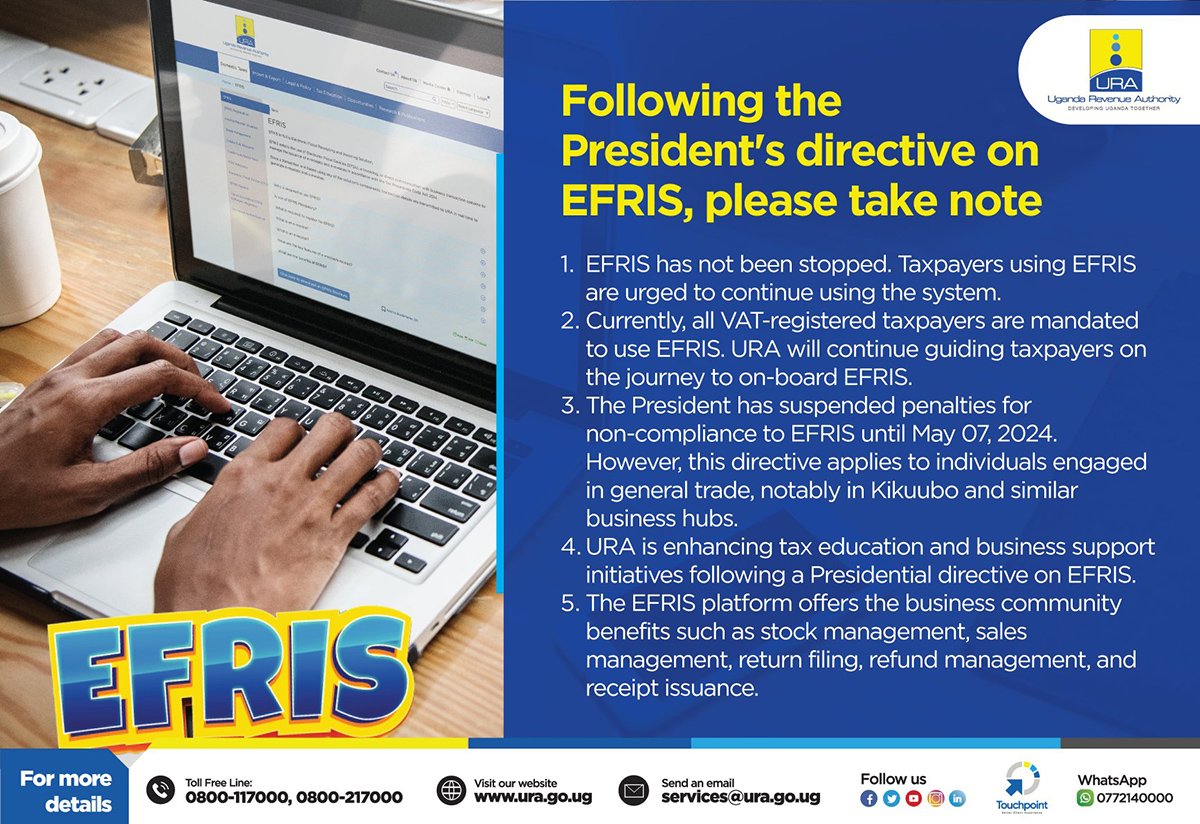

The EFRIS system is intended to help the URA record taxpayers’ transactions and share that information with the URA. This is meant to boost revenue collection. However, some taxpayers are resistant to the system.

The EFRIS system has several benefits for taxpayers, like faster tax refunds and prefilled tax returns. It can also help taxpayers avoid losing physical invoices. Additionally, the URA can use the information from the EFRIS system to analyze different types of taxes.

One way the URA could further incentivize taxpayers to use the EFRIS system is by exempting registered taxpayers from the 6% withholding tax and 6% withholding value-added tax. This would help businesses with their cash flow challenges. The URA already has information about who has filed and paid taxes, so it could easily implement this exemption.

Another challenge is that the EFRIS system can be complex and difficult to understand. The URA could address this by providing more training and education to taxpayers.